SECURITIES AND EXCHANGE COMMISSION

the

Securities Exchange Act of 1934

(Amendment (Amendment No. )

|

|

|

|

|

PRUDENTIAL FINANCIAL, INC.

|

|

|

| |

| ||

| | |

![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

![[MISSING IMAGE: sg_charlesflowrey-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/sg_charlesflowrey-bw.jpg)

Chairman and Chief Executive Officer

Prudential Financial, Inc.

Newark, NJ 07102

| | ![[MISSING IMAGE: ph_charlesflowrey-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ph_charlesflowrey-bw.jpg) | | | ||

![[MISSING IMAGE: ic_quotationopen-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ic_quotationopen-pn.jpg) | |

| All of us at Prudential share a determination to deliver on our promises to stakeholders, including employees, customers, shareholders and the

![[MISSING IMAGE: ic_quotationclose-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ic_quotationclose-pn.jpg) | |

|  |

| | ||||||

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND | | | 1 | |

| | March 28, 2024 | | | |||

|

| |

| |||

| |

![[MISSING IMAGE: lg_prudential-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.jpg) | |

to Our Shareholders

Transformation

Throughout 2021, Prudential made significant progress in executing our transformation strategy to become a higher-growth, less market-sensitive and more nimble company.

We reached agreements to divest our full-service retirement business and sell a portion of our traditional variable annuities, and we completed the sale of our Taiwan insurance business, advancing our pivot toward less market-sensitive, higher-growth businesses. We continue to advance our cost savings program and remain on track to realize $750 million in savings by the end of 2023. With the support of our rock solid balance sheet, we have maintained a disciplined and balanced approach to redeploying capital. These actions are expected to help us build a more sustainable company on behalf of all our stakeholders.

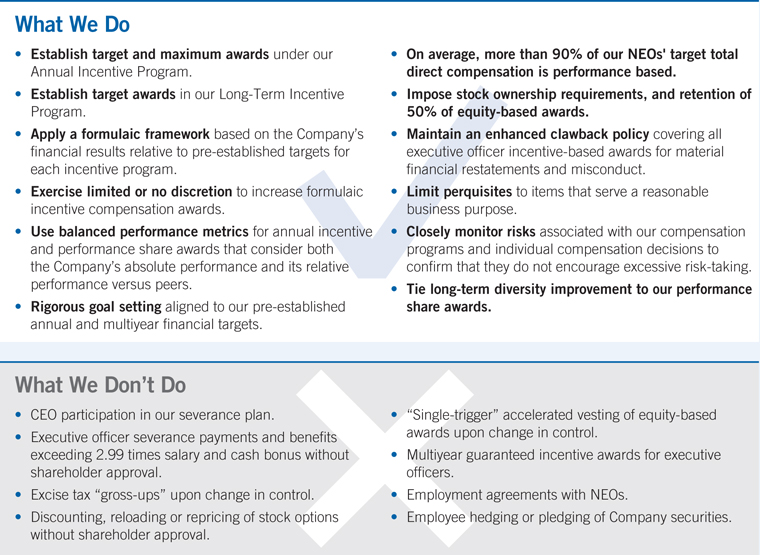

Our executive compensation plan reflects the critical importance the Board has placed on our strategic transformation priorities. In support of transparency and accountability, we are pleased to share with you an overview of the Board’s actions during the past year.

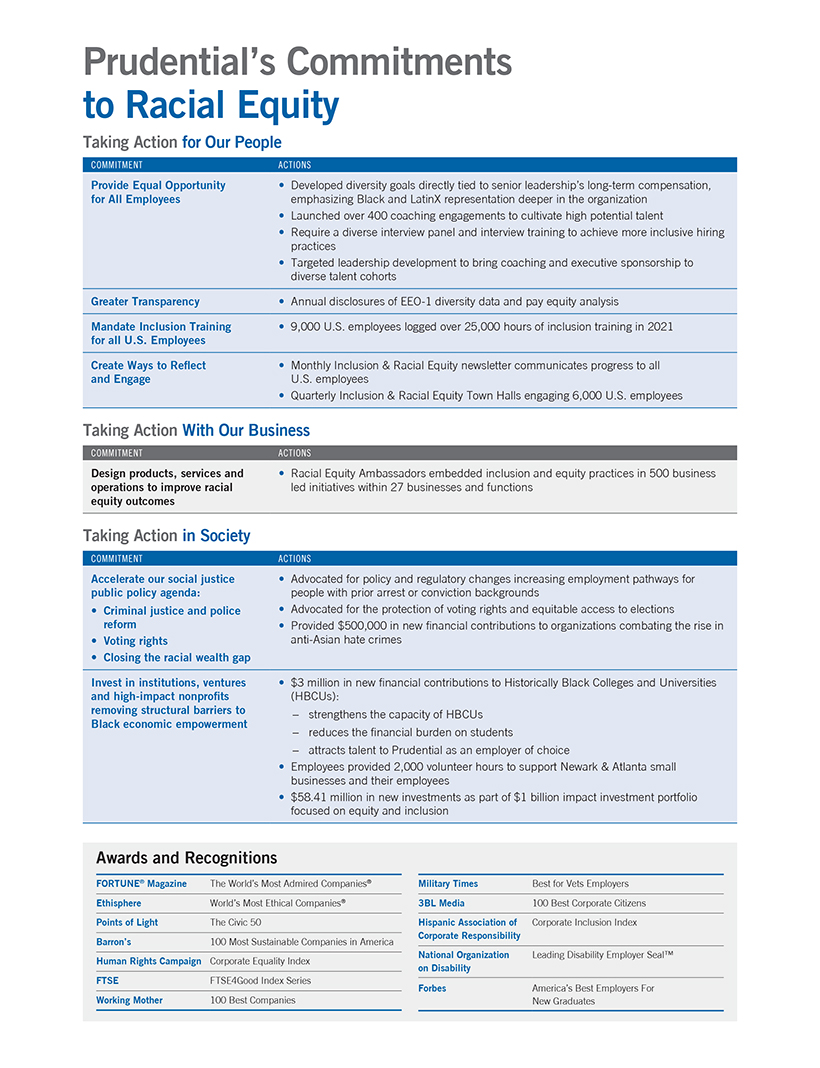

CommitmentJapanese operation and are central to Inclusionour international strategy. In November 2023, we held our Board meeting in Tokyo, Prudential’s headquarters in Japan. Over the course of several days, we met with senior management representing our four Asian businesses to discuss strategic long-term priorities and Diversity

their view of the economic outlook for the region. We also met employees whose observations and experiences reinforced the strength of Prudential’s culture and our commitment to develop talent globally.

| | 2 | | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

Human Capital Development

We believe that all employees deserve equal access

Risk Oversight

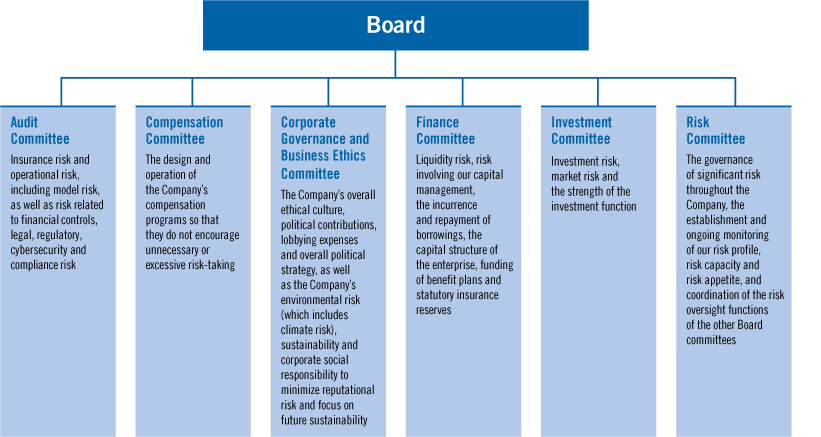

Managing and monitoring risks are important to the Board’s oversight of Prudential. We regularly review the Company’s risk profile, cybersecurity oversight and Board expertise, including its approach to environmental sustainability and human capital management, its operational footprint, and its investment risks and strategies. The Board considers the breadth of the Company’s risk management framework when approving its strategy and risk tolerance and verifies that strategic plans are commensurate with our ability to identify and manage risk. The Board’s Risk Committee includes the chairs of each of the other Board committees, allowing us to coordinate our risk oversight function more closely. The Risk Committee has metrics in place to monitor and review market, insurance, investment, and operational risk.

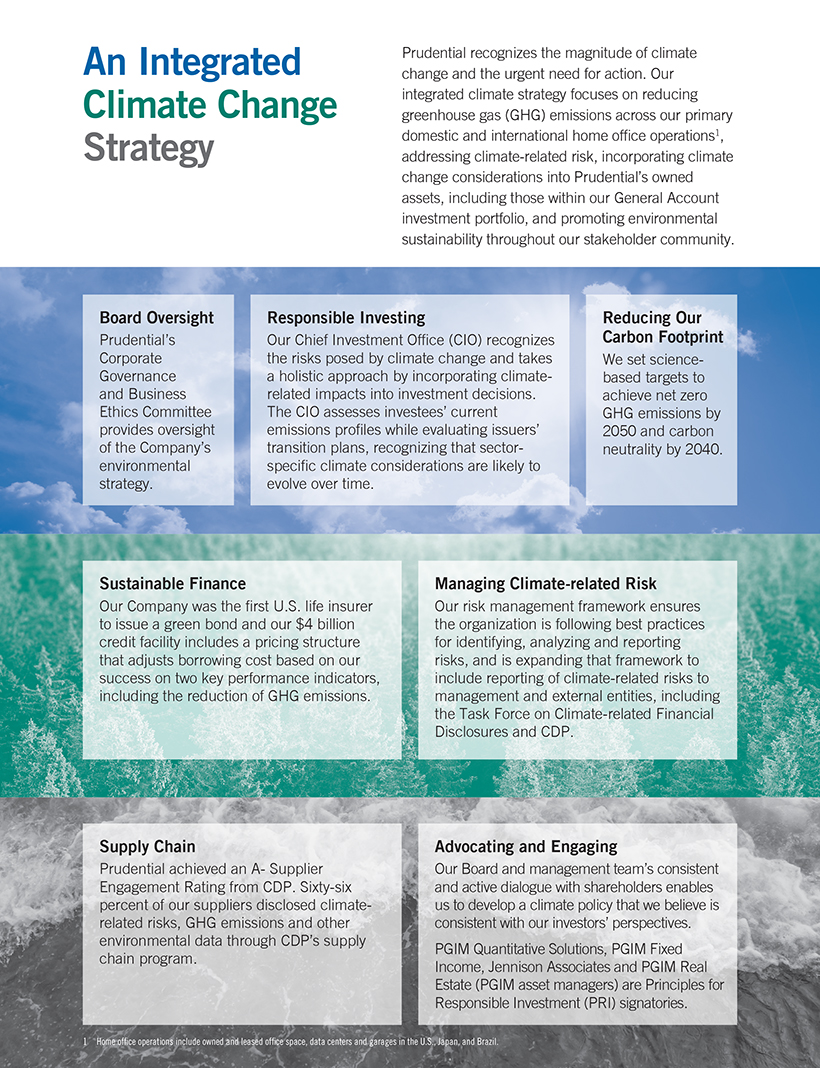

Environmental Sustainability

As a global insurer and investment manager, we understand the magnitude and urgency of climate change, and our responsibility to minimize our impact. Environmental Sustainability is overseen by Prudential’s Corporate Governance and Business Ethics CommitteeUkraine and the full Board of Directors. In 2021, the entire Board participatedearthquakes in environmental sustainability training addressing climate science, climate change policy, reporting frameworks including the Task Force on Climate-related Financial Disclosures,Turkey and the General Account’s ESG framework.

Through the Corporate Governance and Business Ethics Committee, all directors discussed various environmental sustainability issues including Prudential’s plan to achieve net zero greenhouse gas emissions across its primary domestic and international home office operations by 2050. The Corporate Governance and Business Ethics Committee receives environmental sustainability briefings at least quarterly.

Syria.

|

|

We enter 2024 with momentum and optimism. We have expanded and diversified our product offerings, enhanced customer and client experiences and continue to reinvest in our businesses for sustainable long-term growth. On behalf of the entire Board, we are grateful for your support of the Board and Prudential.

Prudential is positioned for success in the coming year given our financial strength, transformation strategy and strong leadership team. We remain confident in our long-term ability to accelerate growth and profitability enhancing value for all stakeholders. We appreciate your investment in Prudential and thank you for the opportunity to serve you and our Company.

| | ![[MISSING IMAGE: sg_gilbertcasellas-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/sg_gilbertcasellas-bw.jpg) Gilbert F. Casellas | | | ![[MISSING IMAGE: sg_kathleenamurphy-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/sg_kathleenamurphy-bw.jpg) Kathleen A. Murphy | |

| ![[MISSING IMAGE: sg_robertfalzon-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/sg_robertfalzon-bw.jpg) Robert M. Falzon |

| | ![[MISSING IMAGE: sg_sandrapianalto-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/sg_sandrapianalto-bw.jpg) Sandra Pianalto | |

| | ![[MISSING IMAGE: sg_martinahundmej-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/sg_martinahundmej-bw.jpg) Martina Hund-Mejean | | | ![[MISSING IMAGE: sg_christinepoon-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/sg_christinepoon-bw.jpg) Christine A. Poon | |

| | ![[MISSING IMAGE: sg_wendyjones-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/sg_wendyjones-bw.jpg) Wendy E. Jones | | | ![[MISSING IMAGE: sg_douglasscovan-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/sg_douglasscovan-bw.jpg) Douglas A. Scovanner | |

| | ![[MISSING IMAGE: sg_charlesflowrey-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/sg_charlesflowrey-bw.jpg) Charles F. Lowrey | ||||

| |

| |||

|

| ||||

|

| ||||

|

| ||||

|

![[MISSING IMAGE: sg_michaeltodman-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/sg_michaeltodman-bw.jpg) Michael A. Todman | ||||

| |||||

| | |||||

| | ||||

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND | | 3 | |

![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif)

of Shareholders of

Prudential Financial, Inc.

| | Agenda | | |||

| | 1. |

| |||

| |

| ||||

| | |||||

|

| | |||

| | 2. | | | Ratification of appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024; | |

| | 3. | | | Advisory vote to approve named executive officer compensation; | |

| | 4. | | | Shareholder proposal | |

| | 5. | | | Shareholders also will act on such other business as may properly come before the meeting or any adjournment or postponement thereof.

| |

March 15, 2024.

| | |||||

By Order of the Board of Directors,

| | ||||

| | ![[MISSING IMAGE: ph_margaretmforan-bw.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ph_margaretmforan-bw.gif) | | | ![[MISSING IMAGE: sg_margaretmforan-bw.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/sg_margaretmforan-bw.gif) Margaret M. Foran Chief Governance Officer, Senior Vice President and Corporate Secretary March 28, 2024 Prudential Financial, Inc. | |

| | Place Prudential Financial’s office located at 751 Broad Street Newark, NJ 07102 | | |||

Date May 14, 2024 | | | Time 2:00 p.m. | | |

| | Direct Deposit Your Prudential Dividend—Save Time, Money and the Environment | | |||

| | By the end of 2024, Prudential will no longer mail paper dividend checks to our registered shareholders. If you are not already enrolled and are a registered shareholder with our transfer agent, Computershare, please do not delay and enroll now to continue to receive your Prudential stock dividends. | | |||

| | How will you benefit from direct deposit? • Security—Reduce the risk of lost or stolen checks. • Convenience—Access your funds immediately. • Timely—Avoid United States Postal Service delays. | | |||

| | There are three easy ways to enroll for this free benefit: | | |||

| | Visit: https://qrco.de/PRU2024 or scan here. | | | | |

| | Call: (800) 305-9404 and say direct deposit after you enter your account information | | | Scan: ![[MISSING IMAGE: ic_prudentialqr-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ic_prudentialqr-bw.jpg) | |

| | 4 | | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

| ||

|

![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif)

| | During the year, we made strong progress executing our transformation to be a higher-growth, more capital-efficient, and more nimble company. We expanded and diversified our product offerings, enhanced customer and client experience, and evolved our operating model, all while continuing to reinvest in our businesses. Our strategic progress and financial strength position us well to navigate the current macroeconomic environment, while maintaining a disciplined approach to capital deployment. Looking ahead, we are well positioned to deliver sustainable long-term growth and be a global leader in expanding access to investing, insurance, and retirement security. | | |||

| | |||||

| Proposal | | | Recommendation of Board | | |

| | |||||

Election of directors | | | FOR each of the nominees | | |

| | |||||

Ratification of independent auditor | | FOR | | ||

| | |||||

executive officer compensation | | FOR | | ||

| | |||||

| | AGAINST | | ||

The Year 2021PrudentialRobert M. Falzon and Charles F. Lowrey. Committee Membership Name Age Independent Director Since Executive Compensation

and Human

Capital Investment Finance Corporate

Governance &

Business Ethics Audit Other

Public

Boards 71 Yes 01/2001 • • C 0 64 No 08/2019 0 63 Yes 10/2010 • • C 1 58 Yes 01/2021 • • • 0 66 No 12/2018 • 0 61 Yes 09/2023 • 0 69 Yes 07/2015 • • 1 71 Yes 09/2006 • • C 3 68 Yes 11/2013 • C • 0

Lead Independent Director

(since 2023) 66 Yes 03/2016 C C • 3

| | ||||

| | | 5 | |

2021

| | Summary Information | | | ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

| 1-Year | 3-Year | 5-Year | ||||||||||

Cumulative TSR | 45% | 55% | 29% | |||||||||

Annualized TSR | 45% | 16% | 5% | |||||||||

Percentile Rank | 77% | 37% | 23% | |||||||||

| | | | | 1-Year | | | 3-Year | | | 5-Year | |

| | Cumulative TSR | | | 10% | | | 54% | | | 64% | |

| | Annualized TSR | | | 10% | | | 15% | | | 10% | |

| | Percentile Rank | | | 39% | | | 72% | | | 48% | |

| Board Committees | | | Independent | |

Audit | | | Yes | |

Corporate Governance & Business Ethics | | | Yes | |

Compensation and Human Capital | | | Yes | |

Finance | | | Yes | |

Investment | | | Yes | |

| | | | | | |

| | Number of Board Meetings Held | | | 8 | |

| Director Attendance Board and Committee Meetings | | | | |

Nine Directors | | | 100% | |

One Director | | | 67%* | |

| 2023 Annual Meeting Proposal Results | | | % Support | |

Election of directors | | | 92.4-98.74% | |

Appointment of the Independent Auditors | | | 95.59% | |

Advisory vote to approve named executive officer compensation | | | 94.52% | |

Advisory vote on the frequency of future advisory votes to approve named executive officer compensation | | | 96.61% | |

Shareholder proposal regarding an Independent Board Chairman | | | 34.95% | |

| Board Structure | | | | |

Chairman Classification | | | Combined | |

Independent Lead Director | | | Yes | |

Number of Directors | | | 10 | |

% Independent | | | 80% | |

% Non-Employee Director Diverse | | | 88% | |

% Women | | | 50% | |

% Racial Diversity | | | 30% | |

Director Average Tenure (years) | | | 9 | |

Director Average Age | | | 65 | |

| Shareholder Rights | | | | |

Classified Board | | | No | |

Shareholder right to call special meetings | | | 10% | |

Material restrictions on right to call special meetings | | | No | |

Shareholder right to act by written consent | | | Unanimous | |

Poison Pill | | | No | |

Proxy Access | | | Yes | |

| | 6 | | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif)

| | ||||

|

|

Corporate Governance

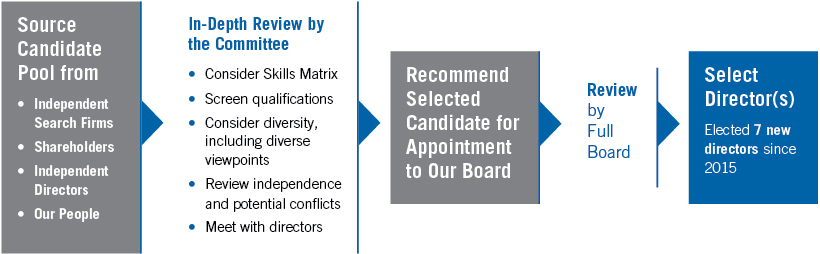

In 2021, management and Board members engaged with shareholders who hold a majority of our shares. During these discussions, shareholders were encouraged to identify potential Board candidates and share feedback on the Company and our Board structure, governance and environmental practices and policies, and our compensation framework and programs.

The Corporate Governance and Business Ethics Committee from time to time reviews outside commitments of all directors to ensure each director has the capacity to fully meet his or her Board responsibilities.

All nominees are independent except for Robert M. Falzon and Charles F. Lowrey.

Board of Directors Nominees and Committees

| Committee Membership | ||||||||||||||||||||||||||

| Name | Age | Independent | Director Since | Executive | Compensation | Investment | Finance | Risk | Corporate Governance & Business Ethics | Audit | Other Public Boards | |||||||||||||||

Thomas J. Baltimore | 58 | Yes | 10/2008 | ● | ● | C |

| ● |

|

| 2 | |||||||||||||||

Gilbert F. Casellas | 69 | Yes | 01/2001 | ● |

|

|

| ● | C |

| 0 | |||||||||||||||

Robert M. Falzon | 62 | No | 08/2019 |

|

|

|

|

|

|

| 0 | |||||||||||||||

Martina Hund-Mejean | 61 | Yes | 10/2010 | ● |

|

|

| ● |

| C | 2 | |||||||||||||||

Wendy E. Jones | 56 | Yes | 01/2021 |

|

|

|

|

|

| ● | 0 | |||||||||||||||

Karl J. Krapek | 73 | Yes | 01/2004 |

| ● |

|

|

|

|

| 2 | |||||||||||||||

Peter R. Lighte | 73 | Yes | 03/2016 |

|

| ● |

|

| ● |

| 0 | |||||||||||||||

Charles F. Lowrey | 64 | No | 12/2018 | ● |

|

|

|

|

|

| 0 | |||||||||||||||

George Paz | 66 | Yes | 03/2016 |

|

|

| ● |

|

| ● | 1 | |||||||||||||||

Sandra Pianalto | 67 | Yes | 07/2015 |

|

|

| ● |

| ● |

| 2 | |||||||||||||||

Christine A. Poon Lead Independent Director (since 2020) | 69 | Yes | 09/2006 | C |

| ● | C | ● |

|

| 2 | |||||||||||||||

Douglas A. Scovanner | 66 | Yes | 11/2013 | ● |

|

|

| C |

| ● | 0 | |||||||||||||||

Michael A. Todman | 64 | Yes | 03/2016 | ● | C |

| ● | ● |

|

| 3 | |||||||||||||||

● Member C Chair

| ||

| ||||||||

| | | | 8 | | | |||

| | ||||||||

| | | | 10 | | | |||

| | ||||||||

| | | | 11 | | | |||

| | | | | | 14 | | | |

| | ||||||||

| | | | 16 | | | |||

| | ||||||||

A Message to Our Shareholders from Prudential’s Lead Independent Director | | | | 19 | | | ||

| | ||||||||

| | | | 20 | | | |||

| | ||||||||

| | | | 23 | | | |||

| | ||||||||

| | | | 24 | | | |||

| | ||||||||

| | | | 25 | | | |||

| | ||||||||

| ||||||||

Item 2 – Ratification of the Appointment of the Independent Registered Public Accounting Firm | | | | | | |||

| | ||||||||

| | | | 29 | | | |||

| | | | | | 30 | | | |

| Shareholder Proposals | | | | | | | |

| | Item 4 – Shareholder Proposal Regarding an Independent Board Chairman | | | | | 31 | | |

| | | |

| | | | ||

| | | | | | 34 | | | |

| | | | | | 36 | | | |

| Compensation Highlights | | | | | 36 | | |

| | Philosophy and Objectives of Our Executive Compensation Program | | | | | 39 | | |

| | How We Make Compensation Decisions | | | | | 41 | | |

| | Direct Compensation Components | | | | | 42 | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | 55 | | | |

| | | | | | 56 | | | |

| | 2023 Summary Compensation Table | | | | | 56 | | |

| | Grants of Plan-Based Awards | | | | | 58 | | |

| | Pension Benefits | | | | | 61 | | |

| | Nonqualified Deferred Compensation | | | | | 65 | | |

| | Post-Employment Compensation Arrangements | | | | | 66 | | |

| | Potential Payments upon Termination or Change in Control | | | | | 67 | | |

| | | | | 69 | | | ||

| | ||||||||

| | | | 69 | | | |||

| | ||||||||

| | | | 71 | | | |||

| | ||||||||

Submission of Shareholder Proposals and Director Nominations | | | | 71 | | | ||

| | | | | | | | ||

| | | | | | | | ||

| ||||

| ||||

| ||||

| ||||

10, 2022,14, 2024, at 2:00 p.m., at Prudential Financial’s office located at 751 Broad Street, Newark, NJ 07102, and at any adjournment or postponement thereof. Proxy materials or a Notice of Internet Availability were first sent to shareholders on or about March 24, 2022.28, 2024. NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 20222024 PROXY STATEMENT 9

![[MISSING IMAGE: lg_prudential-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.jpg)

Election of Directors

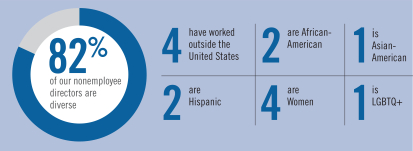

Board Diversity

| | ||||

Our Corporate Governance Principles and Practices place great emphasis on diversity, and, pursuant to our Principles and Practices, the Committee actively considers diversity in recruitment and nominations of directors and assesses its effectiveness in this regard when reviewing the composition of the Board. The current composition of our Board reflects those efforts and the importance of diversity to the Board. | |  | ![[MISSING IMAGE: pc_boardhigh-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/pc_boardhigh-pn.jpg) | |

Board tenure for 2022 nominees

| | ||||

| | | ![[MISSING IMAGE: bc_avrgedirect-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/bc_avrgedirect-pn.jpg) | |

| | The Corporate Governance and Business Ethics Committee practices a long-term approach to board refreshment. With the assistance of an independent search firm, the Committee regularly identifies individuals who have expertise that would complement and enhance the current Board’s skills and experience. In addition, as part of our shareholder engagement dialogue, we routinely ask our investors for input regarding director recommendations. |  |

| | 8 | ||

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND | |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

As part of the Corporate Governance and Business Ethics Committee’s annual review, the Committee considered Mr. Baltimore’s obligations outside of Prudential, including his directorship on other public company boards, and his role as a public company executive officer. The Committee determined that he has demonstrated an ability to fulfill his responsibilities to our Board due to his exemplary leadership and vision, especially in the context of the Company’s diversity and inclusion and succession planning and practices, oversight of Prudential’s transformation strategy, active engagement at all Board meetings and Committee meetings (for Committees where Mr. Baltimore is a member), and Mr. Baltimore’s independent judgment, accountability and collaboration with his peers as reflected in the annual Board evaluation.

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2024 PROXY STATEMENT | | | 9 | |

| | Item 1 Election of Directors | | | ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

| | | |  Casellas | |  | |  Falzon | |  | |  Hund-Mejean | |  | |  Jones | |  | |  Lowrey | |  | |  Murphy | |  | |  Pianalto | | | | Poon | | | | Scovanner | | | | Todman | | |

| | | | | | | | | | | | | | | | | | • | | | | | | • | | | | • | | | | | | | | | | ||||

| | | | • | | | | | | | | | | | | | • | | | | | | | | | | | • | | | | | | | | | | ||||

| | | | | | | | | | | | | | | | | | | • | | | | • | | | | • | | |||||||||||||

| | | | | | | | | | | | | | | | | | | • | | | | • | | | | • | | |||||||||||||

| | | | | | | | | | | | | | | | | | | • | | | | • | | | | • | | |||||||||||||

| | | | • | | | | | | | | | | | | | • | | | | | | | | | | | | | | | | | | | | | | |||

| | | | | | | | | • | | | | | | | | | | | | • | | | | • | | | | • | | |||||||||||

| | | | | | | | | | | | | | | | | | | • | | | | • | | | | • | | |||||||||||||

| | | | | | | | | | • | | | | | | | | | • | | | | • | | | | • | | | | | | |||||||||

| | | | • | | | | | | | | | | | | | | • | | | | | | | | | | | | | | | • | | |||||||

| | | | | | | | | | | | | | | | | | | • | | | | • | | | | • | | |||||||||||||

| | | | | | | | | | | | | | | | | | | • | | | | | | | | | | | | | | | | | | |||||

| | | | | | | | | | | | | | • | | | | | | | | | | • | | | | | | | | • | | ||||||||

| | | | | | | | • | | | | | | • | | | | | | | | | | • | | | | • | | | | | | ||||||||

| | | | | | | | | | | | | • | | | | | | | | | | | | | • | | | | | | | | • | | ||||||

| | | | | | | | | | | | | | | | • | | | | | | | | | | | | | | | • | | | | | | |||||

| | | | | | | | | | | | | | | | | | | • | | | | • | | | | • | | |||||||||||||

| | | | | | | | | | | | • | | | | | | | • | | | | | | | | | | | | | | | | | | |||||

| | 10 | | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

71 Mr. Casellas served as Chairman of OMNITRU (a consulting and investment firm) from 2011 to 2017. He was VP, Corporate Responsibility, of Dell Inc. (a global computer manufacturer) from 2007 to 2010. Mr. Casellas served as Chairman, U.S. EEOC from 1994 to 1998 and General Counsel, U.S. Department of the Air Force, from 1993 to 1994. Mr. Falzon has been Vice Chairman of Prudential Financial since December 2018 and oversees the finance, risk, investments, actuarial, communications, information & technology, and corporate social responsibility functions. Previously, he served as EVP and CFO of Prudential Financial from 2013 to 2018, and has been a member of the Company’s Executive Leadership Team since 2013. Mr. Falzon also served as SVP and Treasurer of Prudential Financial from 2010 to 2013. Mr. Falzon has been with Prudential since 1983, serving in various positions. Ms. Hund-Mejean served as CFO and as a member of the Management Committee at MasterCard Worldwide (a technology company in the global payments industry) from 2007 to 2019. Ms. Hund-Mejean served as SVP and Corporate Treasurer at Tyco International Ltd. from 2003 to 2007; SVP and Treasurer at Lucent Technologies from 2000 to 2002; and held management positions at General Motors Company from 1988 to 2000. Ms. Hund-Mejean began her career as a credit analyst at Dow Chemical in Frankfurt, Germany. The Board of Directors recommends that shareholders vote “FOR” each of the nominees. ![[MISSING IMAGE: ph_gilbertfcasellas-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ph_gilbertfcasellas-bw.jpg)

Thomas J. BaltimoreAge: 58Director Since: October 2008Prudential Committees:● Executive● Compensation● Investment (Chair)● RiskPublic Directorships:● Park Hotels & Resorts, Inc.● The American Express CompanyFormer Directorships Held During the Past Five Years:● AutoNation, Inc. (January 2021)● Duke Realty Corporation (April 2017)Mr. Baltimore has been Chairman, President and CEO of Park Hotels & Resorts, Inc. (an NYSE-listed lodging real estate investment trust) since January 2017. Between May 2016 and January 2017, Mr. Baltimore was President and CEO of the planned Hilton Real Estate Investment Trust. Previously, he was President and CEO of RLJ Lodging Trust (an NYSE-listed real estate investment company) from May 2011 to May 2016. He served as Co-Founder and President of RLJ Development, LLC (RLJ Lodging’s predecessor company) from 2000 to May 2011. Previously, Mr. Baltimore served in various management positions at Hilton Hotels Corporation and Host Marriott Services.

69

(Director of Prudential Insurance since April 1998) ●

Business Ethics (Chair)●● Risk

![[MISSING IMAGE: ph_robertmfalzon-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ph_robertmfalzon-bw.jpg)

Director Since: August 2019 Robert M. FalzonAge: 62Director Since: August 2019 ![[MISSING IMAGE: ph_martinahundmejean-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ph_martinahundmejean-bw.jpg)

Director Since: October 2010

Martina Hund-MejeanAge: 61Director Since: October 2010Prudential Committees:● Audit (Chair)● Executive● RiskPublic Directorships:● Colgate-Palmolive Company● Shell plc

| | ![[MISSING IMAGE: ph_wendyjones-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ph_wendyjones-bw.jpg) | |

| |

|

|

| Wendy E. Jones Age: 58 Director Since: January 2021 | | | Prudential Committees:

• Audit • Compensation and Human Capital • Corporate Governance and Business Ethics | | ||||

| | Ms. Jones served as SVP, Global Operations at eBay, Inc. (a multi-national e-commerce corporation) from October 2016 to December 2020, and was responsible for eBay’s customer service, risk, trust, payment operations and workplace resources functions around the world. During that time, Ms. Jones also served as Chair of eBay’s Operating Committee, which managed the firm’s intersection of product and business teams and oversaw the development and execution of the company’s annual business road map. Prior to that time, she served in various other leadership positions and focused much of her career on eBay’s global presence, including launching eBay in markets such as Brazil, Russia and Mexico and spearheading eBay’s cross-border trade efforts. Prior to joining eBay, Ms. Jones worked in various leadership roles at State Street Bank, Land Rover NA, and for iSKY, Inc. | | |||||||

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2024 PROXY STATEMENT |

| |

| |

| |

Item 1 Election of Directors | | | ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

| |

| |||||||||||

![[MISSING IMAGE: ph_charlesflowrey-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ph_charlesflowrey-bw.jpg) | |

|

| |||||||||

| ||||||||||||

| 66 | | | Prudential Committees:

• Executive | | |||||||

| | Mr. Lowrey has been Chairman and CEO of Prudential Financial, Inc. since December 2018. Prior to assuming his current roles, Mr. Lowrey served as EVP and Chief Operating Officer (COO) of Prudential’s International businesses from 2014 to 2018. Previously, he was EVP and | | ||||||||||

| | ![[MISSING IMAGE: ph_kathleenamurphy-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ph_kathleenamurphy-bw.jpg) | | | Kathleen A. Murphy Age: 61 Director Since: September 2023 | | | Prudential Committees: • Investment | |

| Ms. Murphy retired from FMR LLC (Fidelity Investments), a privately owned financial services company, in July 2023. She served as President of Personal Investing at Fidelity Investments from 2009 to 2021. From 2022 until her retirement, she served as the Senior Advisor to the CEO of Fidelity Investments. She also held various roles with Voya Financial, Inc. (formerly ING) from 2000 to 2008, including CEO, ING U.S. Wealth Management Services from 2006 to 2008, President, ING U.S. Institutional Businesses from 2004 to 2006 and General Counsel and Chief Administrative Officer to the CEO of ING U.S. Financial Services. Prior to that, Ms. Murphy served in various positions at Aetna, Inc., including General Counsel and Chief Compliance Officer of Aetna Financial Services, and in various positions in law, government and public affairs. |

| ||||||

| | ![[MISSING IMAGE: ph_sandrapianalto-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ph_sandrapianalto-bw.jpg) | | | Sandra Pianalto Age: 69 | | | Prudential Committees:

• Corporate Governance and Business Ethics • Investment Former Directorships Held

• The J.M. Smucker Company |

| |||

| |||||||||||

|

|

|

|

| | | Public Directorships:

• Eaton Corporation plc

| | |||

| | |||||||||

Ms. Pianalto served as President and CEO of the Federal Reserve Bank of Cleveland (the Cleveland Fed) from February 2003 until her retirement in May 2014. Ms. Pianalto also served in various executive and supervisory roles at the Cleveland Fed from | | ||||||||

| 12 | | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2024 PROXY STATEMENT | |

| | Item 1 Election of Directors | | | ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

| | ![[MISSING IMAGE: ph_christineapoon-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ph_christineapoon-bw.jpg) | | | Christine A. Poon Age: 71

| | | Prudential Committees:

• Executive

• Finance (Chair)

• Investment

Former Directorships Held

• Decibel Therapeutics, Inc. (December 2021)

• Koninklijke Philips NV (May 2021) | | | Public Directorships:

• Regeneron Pharmaceuticals

• The Sherwin-Williams Company • Neurocrine Biosciences | | ||||

| | Ms. Poon served as Executive in Residence at The Max M. Fisher College of Business at The Ohio State University (“Fisher College of Business”) from 2015 until her retirement in 2020 and served as Professor of Management and Human Resources at The Fisher College of Business from October 2014 to September 2015. Ms. Poon previously served as Dean and John W. Berry, Sr. Chair in Business at The Fisher College of Business at The Ohio State University from April 2009 until October 2014. She served as Vice Chairman and Member of the Board of Directors of Johnson & Johnson from 2005 until her retirement in March 2009. Ms. Poon joined Johnson & Johnson in 2000 as Company Group Chair in the Pharmaceuticals Group. She became a member of Johnson & Johnson’s Executive Committee and Worldwide Chair, Pharmaceuticals Group, in 2001, and served as Worldwide Chair, Medicines and Nutritionals, from 2003 to 2005. Prior to joining Johnson & Johnson, she served in various management positions at Bristol-Myers Squibb for 15 years. | | |||||||||||||

| ![[MISSING IMAGE: ph_douglasascovanner-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ph_douglasascovanner-bw.jpg) | | | Douglas A. Scovanner Age: 68 | | | Prudential Committees:

• Audit

• Executive

• Investment (Chair) | | |||

| | |||||||||||

Mr. Scovanner has been Founder and Managing Member of Comprehensive Financial Strategies, LLC, a management consulting firm, since October 2013. Previously, he served as CFO (1994 to 2012) and EVP (2000 to 2012) of Target Corporation (a North American retailer). Prior to joining Target Corporation, Mr. Scovanner held various management positions at The Fleming Companies, Inc., Coca-Cola Enterprises, Inc., The Coca-Cola Company and the Ford Motor Company. | | ||||||||||

| ![[MISSING IMAGE: ph_michaelatodman-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ph_michaelatodman-bw.jpg) | | | Michael A. Todman Age: 66 Lead Independent Director Since: 2023 | | | Prudential Committees:

• Compensation (Chair)

• Executive

• Finance

|

| |||

| | | Public Directorships: • Brown-Forman Corporation • Carrier Global Corporation • Mondelēz International, Inc. | | |||||||

| | |||||||||||

Mr. Todman served as Vice Chairman of the Whirlpool Corporation (Whirlpool), a global manufacturer of home appliances, from November 2014 to December 2015. Mr. Todman previously served as President of Whirlpool International from 2006 to 2007 and 2010 to 2014, as well as President, Whirlpool North America, from 2007 to 2010. Mr. Todman held several senior positions with Whirlpool over his career. | | ||||||||||

| | ||||||

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND | | | 13 | |

![[MISSING IMAGE: lg_prudential-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.jpg)

| ||

![[MISSING IMAGE: fc_processforselect-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/fc_processforselect-pn.jpg)

| | 14 | | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

| | Corporate Governance | | | ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

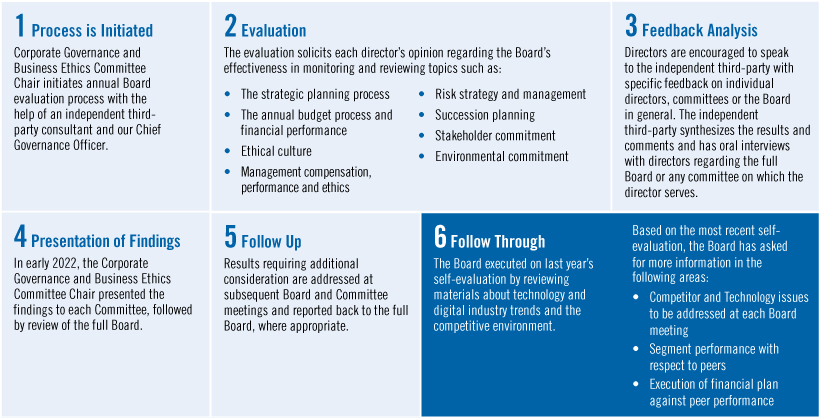

| | Attendance and Active Participation | | | Attendance and interactive contributions at Board and Committee meetings | |

| | Board and Director Evaluations | | | Feedback received during the annual Board evaluation and discussions between each individual director and the Lead Director, Corporate Governance and Business Ethics Committee Chair, and Board Chair | |

| |

Skills, Qualifications and Experience | | | Possession of core competencies and command of contemporary insight into risks and opportunities facing Prudential | |

| | Time Commitment and Outside Board Affiliations | | | Stringent evaluation of overboarding considerations, time commitment and potential conflicts of interest or independence concerns to assess a Director’s capacity to meet their full responsibility | |

| | Diversity of Skills | | | The extent to which the director contributes to the diverse skills of the Board | |

| | Shareholder Feedback | | | Assess shareholder feedback, including support received during the most recent annual shareholder meeting | |

Director Commitments Oversight

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2024 PROXY STATEMENT | | | 15 | |

| | Corporate Governance | | | ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

In addition, the Board had previously determined that Messrs. Baltimore, Krapek and Lighte, were independent while they served on the Board during 2023.

![[MISSING IMAGE: fc_comprehen-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/fc_comprehen-pn.jpg)

| | 16 | ||

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND | |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

![[MISSING IMAGE: fc_shareholderengage-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/fc_shareholderengage-pn.jpg)

| | ||

| ||

In | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2024 PROXY STATEMENT | | | 17 | |

| Corporate Governance | | | ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

| | Lead Independent Director | | |||

| | Under our Corporate Governance Principles and Practices, the independent directors annually elect a Chairman of the Board and, if the individual elected as Chairman of the Board is the CEO, they also elect an independent director to serve as Lead Independent Director. The Lead Independent Director is generally expected to serve for a term of at least one year, but for no more than three years.

| | |||

| Key Responsibilities | | |||

| | • Calls meetings of the independent directors.

• Presides at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors.

• Facilitates communication between the independent directors and our Chairman.

• Provides independent Board leadership.

• Elected annually and may serve no more than three years.

• Approves the agenda for all Board meetings and all Board materials.

• Communicates with shareholders and other key constituents, as appropriate. | |

| • Meets directly with the management and non-management employees of our firm.

• Engages with our other independent directors to identify matters for discussion at executive sessions of independent directors and advises our Chairman of any decisions reached, and suggestions made at the executive sessions.

• In collaboration with the Corporate Governance and Business Ethics Committee, addresses Board effectiveness, performance and composition.

• Authorized to retain outside advisors and consultants who report directly to the Board on Board-wide issues. | |

| | 18 | | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

Shareholder Engagement at Prudential

|

|

As our previous Lead Independent Director, in May 2023. Our directors share my commitment to strong, independent leadership, Board effectiveness and oversight. In this context, I would like to share my reflections on my first year as your Lead Independent Director.

The Board continues to be agile, adapting to changing circumstances. I attribute this todirectors. We are deliberate about maintaining broad attributes of our directors’ skills, varied experiences, and diversity.diverse perspectives. Our 1310 directors maintain broad andexhibit deep experience in strategy development,business transformation, operational excellence, human capital and culture, sustainability, finance, and other important areas that are directly relevant to Prudential’s strategic priorities. In addition to bringing important skills, our Board members represent a wide range of backgrounds and individual experiences, which we believe are reflective of our global operations and diverse consumer base. Of

Regular shareholder feedback informsmembers are available in this proxy statement.

While more work lies ahead, we are pleased with the Company’s progress against our transformation objectives. The Board recognizes that continued strong performance requires vigilant focus on our core business principles, including exceptional client service, operational excellence, and a culture that cultivates strong performing teams. Through our oversight of the Company’s strategic planning process, the Board and management are accountable for abiding by these principles.

On behalf of the Board, thank you for your continuing trust and investment in Prudential.

Christine A. Poon

Lead Independent Director

| | ||||

Todman | |

| Mr. Todman was elected by Prudential’s independent directors to serve as Lead Independent Director effective May | |

|

| | ||||

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND | | | 19 | |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

full Board meets.

![[MISSING IMAGE: fc_boardrisk-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/fc_boardrisk-pn.jpg)

2021,2023, the Risk CommitteeAudit and Finance Committees received updates from the Chief Risk Officer on the important strategic issues and risks facing the Company, including a discussion on the Own RiskORSA, as well as other existing and Solvency Assessment (“ORSA”) and the Company’s current and future initiatives to address climate and environmental relatedsignificant emerging risks. In addition, the Board and committees reviewreviewed the performance and functioning of the Company’s overall risk management function.The Risk Committee currently includes the chairs of each of the other Board committeesfunction, as well as another independent director who serves as Chair ofhow the Committee. The principal activities ofCompany’s risk oversight process aligns with its disclosure controls and procedures. On May 9, 2023, the Risk Committee are to: overseeof the Company’s assessmentCompany was disbanded. Risk issues will continue to be discussed in the relevant Committees and reporting of material risks by reviewingthen discussed when the metrics used by management to quantify risk, applicable risk limit structures and risk mitigation strategies; review the Company’s processes and procedures for risk assessment and risk management, including the related assumptions used across the Company’s businesses and material risk types; and receive reports from management on material and emerging risk topics that are reviewed by the Company’s internal management committees.they overseeshe oversees operate independently of the businesses to separate management and oversight. Also, our employees are evaluated with respect to risk and ethics.

| | 20 | ||

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND | |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

In addition, theall information owned by, or in the care of, the Company. This program also includes a cyber incident response plan that provides controls and procedures for timely and accurate reporting of any material cybersecurity incident. Prudential has not had a material data security breach in three years. The Audit Committee, which is tasked with oversight of certain risk issues, including cybersecurity, receives reports from the Chief Information Security Officer, the Chief Information Officer and the Global Head of Operational Risk Management throughout the year. At least annually, the Board and the Audit Committee also receive updates about the results of program reviews, includingwhich may include exercises and response readiness assessments led by outside advisors who provide a third-party independent assessment of our technical program and internal response preparedness. The Audit Committee regularly briefs the full Board on these matters, and the full Board also receives periodic briefings from internal and external experts on cyber threats in order to enhance our directors’ literacy on cyber issues.Cybersecurity Governance Highlights ● and Risk Committee by our Chief Information Security Officer and our Information Security Office in response to key developments

developments. • Cross-functional approach to addressing cybersecurity risk, with engagement among Global Technology, • Cybersecurity program is integrated within our risk management framework, and includes escalation points to business and corporate function leadership, as well as to the Executive Risk Committee, Enterprise Risk Management Council, and Operating Committee, allowing cyber risk and control items to be elevated to the Board of Directors or its Audit Committee on |

a risk driven basis for calibrated oversight. • Risk environment and associated controls are assessed on an on-going basis considering current and potential future threats. • Global presence with 24/7 cyber threat operations |

• Employees with access to our Company’s systems receive comprehensive annual training on responsible information security, data security, and cybersecurity practices and how to protect data against cyber |

• Our detailed incident response plan specifies escalation and evaluation processes for cyber events. This plan is executed in close coordination with our internal functions including dedicated Cyber Law & Privacy Law function, External Affairs, and Risk Management. • To the extent cybersecurity controls are related to internal control over financial reporting, such controls are considered • Prudential’s security program is aligned, as appropriate based on our platforms, business activities, operating environment, and associated risks, with the National Institute of Standards and Technology Cyber Security Framework (NIST CSF), the International Organization for Standardization (ISO), and other industry-recognized security frameworks. | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2024 PROXY STATEMENT | | | 21 | |

| | Corporate Governance | | | ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

In November 2021, we announced our commitment to achieve net-zero emissions across our primary domestic and international home office operations by 2050. To accelerate the Company’s longstanding commitment to mitigate the impacts of climate change, we also set an interim goal to become carbon neutral by 2040. These actions are aligned with the latest climate science of limiting global warming to 1.5 degrees Celsius or lower, as specified in the Paris Climate Accord.

|

|

Human Capital Management and Succession Planning

| Male | Female | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SECTION D - EMPLOYMENT DATA JOB CATEGORIES |

Hispanic or Latino |

|

| Native Islander |

|

| Two or races |

|

|

| Native Islander |

|

| Two or races |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Male | Female | White | Black | Asian | Indian | White | Black | Asian | Indian | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Executive/Senior Level Officials and Managers | 23 | 9 | 336 | 15 | 0 | 44 | 0 | 3 | 162 | 13 | 0 | 23 | 0 | 4 | 632 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

First/Mid-Level Officials and Managers | 150 | 93 | 2,269 | 105 | 5 | 519 | 3 | 35 | 1,345 | 117 | 5 | 352 | 6 | 25 | 5,029 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Professionals | 241 | 313 | 2,084 | 220 | 9 | 459 | 1 | 56 | 2,746 | 550 | 8 | 492 | 4 | 68 | 7,251 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Sales Workers | 73 | 44 | 655 | 131 | 1 | 53 | 7 | 31 | 302 | 119 | 1 | 46 | 5 | 32 | 1,500 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Administrative Support Workers | 83 | 226 | 365 | 101 | 1 | 26 | 0 | 7 | 965 | 368 | 2 | 64 | 5 | 52 | 2,265 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Service Workers | 4 | 4 | 8 | 7 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 24 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

TOTAL | 574 | 689 | 5,717 | 579 | 16 | 1,101 | 11 | 132 | 5,521 | 1,167 | 16 | 977 | 20 | 181 | 16,701 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

30, 2024.

| | | | | | | | | | | | | | | Male | | | Female | | | | | | | | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JOB CATEGORIES | | | Hispanic or Latino | | | White | | | Black | | | Asian | | | Native Hawaiian or Other Pacific Islander | | | Indian | | | Two or more races | | | White | | | Black | | | Asian | | | Native Hawaiian or Other Pacific Islander | | | Indian | | | Two or more races | | | Total | | ||||||||||||||||||||||||||||||||||||||||||||||||

| | Male | | | Female | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Executive/Senior Level Officials and Managers | | | | | 26 | | | | | | 13 | | | | | | 320 | | | | | | 14 | | | | | | 39 | | | | | | 0 | | | | | | 0 | | | | | | 3 | | | | | | 140 | | | | | | 12 | | | | | | 26 | | | | | | 0 | | | | | | 0 | | | | | | 3 | | | | | | 596 | | |

First/Mid-Level Officials and Managers | | | | | 146 | | | | | | 90 | | | | | | 2,014 | | | | | | 89 | | | | | | 519 | | | | | | 2 | | | | | | 2 | | | | | | 34 | | | | | | 1,213 | | | | | | 128 | | | | | | 346 | | | | | | 4 | | | | | | 4 | | | | | | 29 | | | | | | 4,620 | | |

Professionals | | | | | 287 | | | | | | 333 | | | | | | 2,095 | | | | | | 295 | | | | | | 671 | | | | | | 6 | | | | | | 4 | | | | | | 80 | | | | | | 2,462 | | | | | | 594 | | | | | | 609 | | | | | | 7 | | | | | | 3 | | | | | | 89 | | | | | | 7,535 | | |

Sales Workers | | | | | 86 | | | | | | 70 | | | | | | 518 | | | | | | 140 | | | | | | 29 | | | | | | 0 | | | | | | 3 | | | | | | 34 | | | | | | 279 | | | | | | 249 | | | | | | 21 | | | | | | 1 | | | | | | 7 | | | | | | 55 | | | | | | 1,492 | | |

Administrative Support Workers | | | | | 52 | | | | | | 185 | | | | | | 230 | | | | | | 102 | | | | | | 25 | | | | | | 1 | | | | | | 0 | | | | | | 11 | | | | | | 739 | | | | | | 390 | | | | | | 62 | | | | | | 1 | | | | | | 5 | | | | | | 53 | | | | | | 1,856 | | |

Service Workers | | | | | 5 | | | | | | 4 | | | | | | 8 | | | | | | 6 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 1 | | | | | | 1 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 25 | | |

TOTAL | | | | | 602 | | | | | | 695 | | | | | | 5,185 | | | | | | 646 | | | | | | 1,283 | | | | | | 9 | | | | | | 9 | | | | | | 162 | | | | | | 4,834 | | | | | | 1,374 | | | | | | 1,064 | | | | | | 13 | | | | | | 19 | | | | | | 229 | | | | | | 16,124 | | |

| | 22 | | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2024 PROXY STATEMENT | |

| | Corporate Governance | | | ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

Board of Directors

c/o Margaret M. Foran, Chief Governance Officer,

Senior Vice President and Corporate Secretary

751 Broad Street

Newark, NJ 07102

Email: independentdirectors@ prudential.com

| | ||||||

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND | | | 23 | |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

and Human Capital Committee & Business Ethics Committee Investment and Risk.Investment. The primary responsibilities of each of the committees are set forth below, together with their current membership and the number of meetings held in 2021.2023. Committee charters can be found on our website at www.prudential.com/governance. Each member of the Audit, Compensation and Human Capital, and Corporate Governance and Business Ethics Committees has been determined by the Board to be independent for purposes of the NYSE Corporate Governance listing standards. In addition, directors who serve on the Audit Committee and the Compensation and Human Capital Committee meet additional, heightened independence and qualification criteria applicable to directors serving on these committees under the NYSE listing standards.Committees Current Members Description 2021: 102023: 13 Martina-Hund Mejean (Chair)

Wendy E. Jones

Douglas A. ScovannerGeorge Paz The Audit Committee provides oversight of the Company’s accounting and financial reporting and disclosure processes, the adequacy of the systems of disclosure and internal control established by management, and the audit of the Company’s financial statements. The Audit Committee oversees insurance risk and operational risks, risks related to financial controls, and legal, regulatory, cybersecurity and compliance matters, and oversees the overall risk management governance structure and risk management function. 2021:2023: 6 Thomas J. BaltimoreKarl J. Krapek

Gilbert F. Casellas

Wendy E. Jones The Compensation and Human Capital Committee oversees the Company’s programs and practices related to talent and leadership; compensation of the Company’s executive officers; administration of the equity-based and benefitscertain other compensation plans; management of risks for succession planning and compensation; and strategies and policies and programs.related to human capital management. For more information on the responsibilities and activities of the Compensation and Human Capital Committee, including the Committee’s processes for determining executive compensation, see the CD&A. 2021: 72023: 6 Peter R. Lighte

Wendy E. Jones

Sandra Pianalto The Corporate Governance and Business Ethics Committee oversees the Board’s corporate governance procedures and practices, including the recommendations of individuals for the Board, making recommendations to the Board regarding director compensation, and overseeing the Company’s ethics and conflict-of-interest policies, its political contributions and lobbying expenses policy, and its strategy and reputation policy regarding ESGenvironmental, social and governance issues, including environmental stewardship, sustainability, climate, human capital management issues, including inclusion and diversity,external reporting, and corporate social responsibility throughoutfor the Company’s global businesses. 2021:2023: 0

Gilbert F. Casellas

Martina Hund-Mejean

Charles F. Lowrey

Christine A. Poon (Chair)Thomas J. BaltimoreGilbert F. CasellasMartina Hund-MejeanCharles F. Lowrey

Douglas A. ScovannerMichael A. Todman The Executive Committee is authorized to exercise the corporate powers of the Company between meetings of the Board, except for those powers reserved to the Board by our By-laws or otherwise. 2021:2023: 6 Christine A. Poon (Chair) George PazSandra Pianalto

Martina Hund-Mejean

Michael A. Todman The Finance Committee oversees, takes actions, and approves policies with respect to capital, liquidity, borrowing levels, reserves, benefit plan funding, and major capital expenditures.expenditures, and oversight of the ORSA and the Company’s Risk Appetite Framework.

Committee2021:2023: 4 Thomas J. BaltimorePeter R. Lighte

Kathleen A. Murphy

Sandra Pianalto

Christine A. Poon The Investment Committee oversees and takes actions with respect to the acquisition, management and disposition of invested assets; reviews the investment performance of the pension plan and funded employee benefit plans;assets and reviews investment risks and exposures, as well as the investment performance of products and accounts managed on behalf of third parties. 2021: 52023: 2 Douglas A. Scovanner (Chair)Thomas J. BaltimoreGilbert F. CasellasMartina Hund-MejeanChristine A. PoonMichael A. Todman The Risk Committee overseeswas disbanded because the governance of significant risks throughout the enterprise by coordinating theBoard and Committees sufficiently integrated risk oversight functions of each Board committeein their agendas and seeing that matters are appropriately elevated to the Board.decisions. eleven8 meetings in 2021.2023.

| | 24 | | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

2023: The ●to any transaction or series of transactions in which the Company or a subsidiary is a participant;●when the amount involved exceeds $120,000; and●when a related party (a director or executive officer of the Company, any nominee for director, any shareholder owning an excess of 5% of the total equity of the Company and any immediate family member of any such person) has a direct or indirect material interest (other than solely as a result of being a director or trustee or in any similar position or a less-than-10% beneficial owner of another entity).two transactions qualifyone transaction qualifies as a disclosable related party transaction since the beginning of 2021:Brett Sleyster, the son of Scott Sleyster, our Executive Vice President and Head of International Businesses, is employed as an Associate for PruVen Capital Partners GP, LLC (“PruVen Capital’’) and performs services for PruVen Capital and other affiliated and associated entities. Prudential provides 99% of PruVen Capital’s investable capital. Over a contract term of sixteen months, Brett Sleyster’s total expected compensation will be less than $190,000 and is similar to the compensation of other employees holding equivalent positions.employed as aour Vice President Information Systems.and Business Technology Officer, Retail Advice Solutions. In 2021,2023, the total compensation paid to Michael Falzon, including salary, bonus and the grant date value of long-term incentive awards, was less than $540,000.$700,000. Michael Falzon’s compensation iswas similar to the compensation of other employees holding equivalent positions. 2021 2023 CPA-Zicklin Index of Corporate Political Disclosure and Accountability ranked Prudential as a Trendsetter company, the highest distinction. This is the seventheighth consecutive year that Prudential has been recognized for its disclosure, accountability, and political spending oversight.

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND | | | 25 | |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

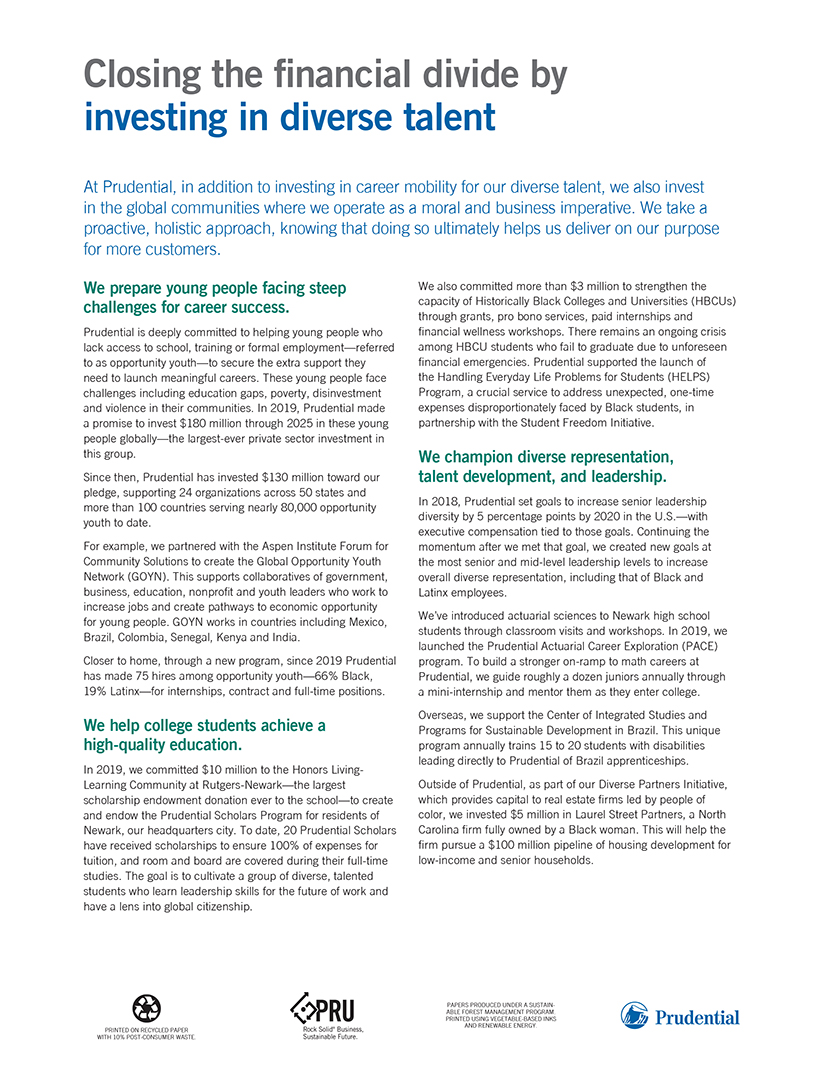

Environmental, Sustainability and The Corporate Governance and Business Ethics Committee has oversightImpact Investingenvironmental and climate issues and policies. In addition, three of our independent Board members sit on ourPrudential’s Corporate Social Responsibility Oversight Committee. This Committee in addition to inclusion and diversity,(CSROC). The CSROC oversees the Company’sPrudential’s corporate social responsibility work including philanthropy, corporate contributions, employee volunteerism and community engagement, market-facing diversity, equity, and inclusion efforts, inand impact investing, strategic philanthropy, employee engagement and corporate community involvement.responsible investing. Our 20212023 activities in these areas include:

![[MISSING IMAGE: tb_activities-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/tb_activities-pn.jpg)

Prudential is more than a world-class financial services company. We are a citizen, a neighbor and a leader with a deeply engrained responsibility to make a long-term, positive impact on the world around us. Our talent and culture are differentiators in the market and the foundation of our success. We are committed to fostering an environment of inclusion where all Prudential employees feel empowered and encouraged to make an impact in their careers and community. In 2023, over 3,500 employees provided 39,470 volunteer hours to support over 500 nonprofit organizations and small businesses. Our annual global employee survey enables Prudential’s management team to understand our employees’ perceptions of corporate culture, leadership, development opportunities, inclusive attitudes, and key organizational issues. In 2023, survey participation increased to a record 87% response rate from over 30,000 employees globally — demonstrating our employees’ willingness to give us feedback regarding how we are meeting their needs. Survey results are discussed with the Board at least annually. Senior leaders are committed to incorporating the survey results into their ongoing organizational plans.

| | 26 | | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

![[MISSING IMAGE: lg_prudential-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.jpg)

| ||

|

Ratification of the Appointment of

the Independent Registered Public

Accounting Firm

Worldwide Fees (in millions)

| Service | 2021 | 2020 | ||||

Audit (1) |

$ |

54 |

|

$ 55 | ||

Audit-Related (2) |

$ |

10 |

|

$ 8 | ||

Tax (3) |

$ |

2 |

|

$ 2 | ||

All Other |

$ |

0 |

|

$ 0 | ||

Total |

$ |

66 |

|

$ 65 | ||

|

|

|

2022.

Worldwide Fees (in millions) Service | | | 2023 | | | 2022 | | ||||||

Audit(1) | | | | $ | 62 | | | | | $ | 51 | | |

Audit-Related(2) | | | | $ | 6 | | | | | $ | 17 | | |

Tax(3) | | | | $ | 3 | | | | | $ | 3 | | |

All Other | | | | $ | 0 | | | | | $ | 0 | | |

Total | | | | $ | 71 | | | | | $ | 71 | | |

2022. The $5 million increase from 2022 is primarily driven by new audit and tax engagements stemming from acquisition activity along with other strategic initiatives of the Company.

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2024 PROXY STATEMENT | | | 27 | |

| | Item 2 Ratification of the Appointment of the Independent Registered Public Accounting Firm | | | ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

| | |||||

|

|

In determining whether to reappoint PwC as Prudential Financial’s independent auditor, the Audit Committee annually considers several factors, including: | | ||||

| • the firm’s independence and objectivity;

• the firm’s capability and expertise in handling the breadth and complexity of Prudential’s global operations and risk profile, including the expertise and capability of the Lead Audit Partner;

• the length of time the firm has been engaged; • the extent and quality of the firm’s communications with the Audit Committee; | |

| • the results of a management survey of PwC’s overall

• other data related to audit quality and performance, including recent Public Company Accounting Oversight Board (“PCAOB”) inspection reports; and

• the appropriateness of the firm’s fees, both on an absolute basis and as compared with the Company’s peers. | |

| | ||

| The Board of Directors recommends that shareholders vote “FOR” ratification of the appointment of PricewaterhouseCoopers as the Company’s Independent Auditor for | |

| | 28 | | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

Thethe Audit CommitteeFourourthe Audit Committee members, Messrs. Paz and Scovanner and Mses. Hund-Mejean and Jones and Mr. Scovanner, satisfy the financial expertise requirements of the NYSENew York Stock Exchange (“NYSE”) and that each of Messrs. Paz and Scovanner and Mses. Hund-Mejean and Jones and Mr. Scovanner has the requisite experience to be designated an audit committee financial expert as that term is defined by rules of the SEC.20212023, and Management’s Annual Report on Internal Control Over Financial Reporting with management and Prudential Financial’s independent auditor. The Audit Committee also discussed with Prudential Financial’s independent auditor matters required under the rules adopted by the PCAOB and the SEC, including the independent auditor’s communication of its Audit Report to the Audit Committee. This report includes critical audit matters, which are audit matters that were communicated or required to be communicated to the Audit Committee relating to accounts or disclosures that are material to Prudential Financial’s financial statements and that involved especially challenging, subjective or complex auditor judgment.TheIn addition to private meetings with the Chief Financial Officer, Chief Risk Officer, Chief Actuary, General Counsel and Chief Compliance Officer, the Audit Committee meets with the Chief Auditor and the independent auditor, with and without management present, to discuss the results of their respective audits, in addition to private meetings with the Chief Financial Officer, Chief Risk Officer, General Counsel, Chief Actuary and Chief Compliance Officer.audits. In determining whether to reappoint PricewaterhouseCoopers as Prudential Financial’s independent auditor, the Audit Committee took into consideration a number of factors, including the length of time the firm has been engaged, the firm’s independence and objectivity, PwC’sits capability and expertise in handling the breadth and complexity of Prudential’s global operations includingand risk profile, the expertise and capability of the Lead Audit Partner, historical and the length of time the firm has been engaged. It also considered recent and historical performance, including the extent and quality of PwC’s communications with the Audit Committee, the results of a management survey of PwC’s overall performance, including overall quality of audit work and adherence to commitments, and other data related to audit quality and performance, including recent PCAOB inspection reports on the firm, and the appropriateness of PwC’s fees, both on an absolute basis and as compared with Prudential Financial’s peers.20212023 for filing with the SEC.

Wendy E. JonesGeorge Paz

Douglas A. Scovanner

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

![[MISSING IMAGE: lg_prudential-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.jpg)

Advisory Vote to Approve Named

Executive Officer Compensation

| | ||

| The Board of Directors recommends that shareholders vote “FOR”

| |

| | 30 | | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

![[MISSING IMAGE: lg_prudential-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.jpg)

| ||

|

Independent Board Chairman management party line.

Shareholder Proposal Regarding an

Independent Board ChairmanShareholder Right to Act by Written Consent![[MISSING IMAGE: ic_sharehold-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/ic_sharehold-pn.jpg)

boardcurrent CEO or for the next CEO transition.takea CEO and a Chairman who is completely independent of the necessary stepsCEO and our Company.permit written consent byhave an independent Chairman of the Board when there is a weak Lead Director. The Prudential Financial Lead Director, Ms. Christine Poon, violates the most important attribute of a Lead Director—independence. As director tenure goes up director independence goes down. Ms. Poon has 15-years director tenure at Prudential.entitled to casthave the minimum number of votes that would be necessary to authorize the action at a meeting at which all shareholders entitledoption to vote thereon were presentagainst Ms. Poon. Prudential’s previous Lead Director Mr. Thomas Baltimore was rejected by more than 30% of Prudential shares each in 2019, 2020 and voting.Hundreds of major companies enable shareholder action by written consent. 2022.won majority shareholder support at 13 large companies in a single year. This included 67%received 47%-support at both Allstate and Sprint.Prudential in 2020. This proposal topic also won 63%47%-support at Cigna Corp. in 2019. This proposal topic would have received higher votes than 63% to 67% at these companies if morelikely represented a resounding majority vote from the shareholders who had access to independent proxy voting advice.Thisadvice and make the most informed voting decisions of all shareholders. It takes more shareholder conviction of the merits of this proposal topic also won 85% support atto vote for it than to simply follow the 2021 Conagra annual meeting without any special effort by the proponent.Taking action by written consent in place of a meeting is also a means shareholders can use to raise important matters outside the normal annual meeting cycle like the election of a new director. For instance the replacement of the director who received the most against votes.Mr. Thomas Baltimore received 67 million against votes in 2021 which equaled a negative percentage of 29%. This was up to 40-times the negative votes of other Prudential directors. Mr. Charles Lowrey, Prudential Chairman and CEO, received the third highest negative votes of any Prudential director in 2021.If shareholders have the right to act by written consent, Mr. Baltimore and Prudential may be inspired to correct the factors behind Mr. Baltimore’s against votes and other directors might avoid getting in the situation Mr. Baltimore is in.Shareholder Right to Act by Written Consent—Independent Board Chairman—Proposal 4

| | ||||||

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND | | | 31 | |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

| | ||||

| | |||

| | ||

| Therefore, Your Board Recommends That You Vote “AGAINST” This Proposal. | |

| | 32 | | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

![[MISSING IMAGE: lg_prudential-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.jpg)

| ||

Name and Address of Beneficial

| | | Amount and Nature | | | Percent of Class | | |

| ||||||||

| | | 32,541,140(1) | | | 9.0% | | |

|

100 Vanguard Boulevard Malvern, PA 19355 | | | 42,287,607(2) | | | 11.71% | |

|

|

|

| Name of Beneficial Owner | Common Stock | Number of Shares Subject to Exercisable Options | Total Number of Shares Beneficially Owned1 | Director Deferred Stock Units / Additional Underlying Units2,3,4,5 | Total Shares Beneficially Owned Plus Underlying Units | |||||||||||||||

Thomas J. Baltimore, Jr. | 500 | 500 | 69,578 | 70,078 | ||||||||||||||||

Gilbert F. Casellas | 500 | 500 | 36,155 | 36,655 | ||||||||||||||||

Martina Hund-Mejean | 128 | 128 | 29,181 | 29,309 | ||||||||||||||||

Wendy E. Jones | 1,000 | 1,000 | 4,284 | 5,284 | ||||||||||||||||

Karl J. Krapek | 38,455 | 38,455 | 7,309 | 45,764 | ||||||||||||||||

Peter R. Lighte | 80 | 80 | 15,028 | 15,108 | ||||||||||||||||

George Paz | 500 | 500 | 15,024 | 15,524 | ||||||||||||||||

Sandra Pianalto | 451 | 451 | 14,510 | 14,961 | ||||||||||||||||

Christine A. Poon | 11,583 | 11,583 | 15,747 | 27,330 | ||||||||||||||||

Douglas A. Scovanner | 14,398 | 14,398 | 21,800 | 36,198 | ||||||||||||||||

Michael A. Todman | 3,325 | 3,325 | 15,028 | 18,353 | ||||||||||||||||

Charles F. Lowrey | 87,571 | 213,253 | 300,824 | 313,336 | 614,160 | |||||||||||||||

Robert M. Falzon | 122,008 | 6 | 171,202 | 293,210 | 249,817 | 543,027 | ||||||||||||||

Scott G. Sleyster | 80,525 | 143,534 | 224,059 | 140,419 | 364,478 | |||||||||||||||

Andrew F. Sullivan | 13,989 | 21,685 | 35,674 | 122,860 | 158,534 | |||||||||||||||

Kenneth Y. Tanji | 4,141 | 73,749 | 77,890 | 96,682 | 174,572 | |||||||||||||||

| All directors and executive officers as a group (22 persons) | 430,092 | 750,892 | 1,180,984 | 1,464,517 | 2,645,501 | |||||||||||||||

|

|

|

|

|

|

| Name of Beneficial Owner | | | Common Stock | | | Number of shares Subject to Exercisable Options | | | Total Number of Shares Beneficially Owned(1) | | | Director Deferred Stock Units / Additional Underlying Units(2)(3)(4) | | | Total Shares Beneficially Owned Plus Underlying Units | | ||||||||||||

Gilbert F. Casellas | | | | | 500 | | | | | | | | | | | | 500 | | | | 40,349 | | | | | 40,849 | | |

Martina Hund-Mejean | | | | | 128 | | | | | | | | | | | | 128 | | | | 35,834 | | | | | 35,962 | | |

Wendy Jones | | | | | 1,000 | | | | | | | | | | | | 1,000 | | | | 7,404 | | | | | 8,404 | | |

Kathleen Murphy | | | | | 0 | | | | | | | | | | | | 0 | | | | 1,593 | | | | | 1,593 | | |

Sandra Pianalto | | | | | 451 | | | | | | | | | | | | 451 | | | | 19,573 | | | | | 20,024 | | |

Christine A. Poon | | | | | 11,583 | | | | | | | | | | | | 11,583 | | | | 17,729 | | | | | 29,312 | | |

Douglas A. Scovanner | | | | | 19,516 | | | | | | | | | | | | 19,516 | | | | 22,434 | | | | | 41,950 | | |

Michael A.Todman | | | | | 3,325 | | | | | | | | | | | | 3,325 | | | | 20,148 | | | | | 23,473 | | |

Charles F. Lowrey | | | | | 179,298 | | | | | | 244,410 | | | | | | 423,708 | | | | 334,279 | | | | | 757,987 | | |

Robert M. Falzon | | | | | 202,250 (5) | | | | | | 195,977 | | | | | | 398,227 | | | | 267,424 | | | | | 665,651 | | |

Caroline Feeney | | | | | 19,239 | | | | | | 6,662 | | | | | | 25,901 | | | | 152,744 | | | | | 178,645 | | |

Andrew F. Sullivan | | | | | 14,103 | | | | | | 34,073 | | | | | | 48,176 | | | | 130,061 | | | | | 178,237 | | |

Kenneth Y. Tanji | | | | | 24,118 | | | | | | 60,385 | | | | | | 84,503 | | | | 99,162 | | | | | 183,665 | | |

Yanela Frias | | | | | 14,066 | | | | | | 3,942 | | | | | | 18,008 | | | | 20,220 | | | | | 38,228 | | |

All directors and executive officers as a group (18 persons) | | | | | 592,874 | | | | | | 611,460 | | | | | | 1,204,334 | | | | 1,416,802 | | | | | 2,621,136 | | |

| | ||||||

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND | | | 33 | |

![[MISSING IMAGE: lg_prudential-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.jpg)

| ||

| Compensation Element | | | Director Compensation Program | |

| | ||||

Annual Cash Retainer | | | $150,000, which may be deferred, at the director’s option | |

| | ||||

Annual Equity Retainer | | | $150,000 in restricted stock units that vest after one year (or, if earlier, on the date of the next Annual Meeting) | |

| | ||||

Board and Committee Fees | | | None | |

| | ||||

Chair Fee | | | $35,000 for the Audit Committee which was disbanded in May 2023) $30,000 for the Compensation Committee $20,000 for all other committees(1) | |

Lead Independent Director Fee | | | $50,000 | |

| | ||||

Meeting Fee for Members of the Company’s Corporate Social Responsibility Oversight Committee(2) | | | $1,250 per meeting (fee contingent on meeting attendance) | |

| | ||||

New Director Equity Award | | | $150,000 in restricted stock units that vest after one year | |

| | ||||

Stock Ownership Guideline | | | Ownership of Common Stock or deferred stock units that have a value equivalent to six times the annual cash retainer to be satisfied within six years of joining the Board(3) | |

|

|

|

| | 34 | | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND |

| | ||||||

| |

| ![[MISSING IMAGE: lg_prudential-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-040492/lg_prudential-pn.gif) | |

Thomas J. Baltimore Gilbert F. Casellas Martina Hund-Mejean Wendy E. Jones(3) Karl J. Krapek Peter R. Lighte George Paz Sandra Pianalto Christine A. Poon Douglas A. Scovanner Michael A. Todman2021 Fees Earned or Paid in Name Cash($) Stock Awards($)(1) All Other Compensation($)(2) Total($) $ 170,000 $150,000 $ 320,000 $ 173,750 $150,000 $ 323,750 $ 185,000 $150,000 $ 335,000 $ 150,000 $300,000 $ 450,000 $ 150,000 $150,000 $ 300,000 $ 153,750 $150,000 $ 303,750 $ 150,000 $150,000 $5,000 $ 305,000 $ 153,750 $150,000 $5,000 $ 308,750 $ 225,000 $150,000 $ 375,000 $ 185,000 $150,000 $ 335,000 $ 180,000 $150,000 $ 330,000 (1)Represents amounts that are in units of our Common Stock. The amounts reported represent the aggregate grant date fair value of the restricted stock units granted during the fiscal year, as calculated under the Financial Accounting Standards Board’s Accounting Codification Topic 718 (“ASC Topic 718”). Under ASC Topic 718, the grant date fair value is calculated using the closing market price of our Common Stock on the date of grant, which is then recognized, subject to market value changes, over the requisite service period of the award. The aggregate balance in each of the nonemployee directors’ accounts in the Deferred Compensation Plan denominated in units (which includes all deferrals from prior years and earned units deferred in 2021) and their value as of December 31, 2021 were as follows: Mr. Baltimore: 69,578 and $7,531,123 ; Mr. Casellas: 36,155 and $3,913,417; Ms. Hund-Mejean: 29,213 and $3,162,015; Ms. Jones: 2,230 and $241,375; Mr. Krapek: 7,309 and $791,126; Mr. Lighte: 15,028 and $1,626,631; Mr. Paz: 15,024 and $1,626,198; Ms. Pianalto: 14,546 and $1,574,459; Ms. Poon: 15,747 and $1,704,455; Mr. Scovanner: 23,113 and $2,501,751; and Mr. Todman: 15,028 and $1,626,631.(2)Amounts represent matching charitable contributions.(3)Ms. Jones received a grant of restricted stock units valued at $150,000 upon joining the Board in January 2021. Fees Earned or Paid in

Compensation

($)(2) Total

($) Name Cash

($)

($)(1) $ 34,018 $ 0 $ 34,018 $ 173,750 $ 150,000 $ 2,600 $ 326,350 $ 185,000 $ 150,000 $ 5,000 $ 340,000 $ 150,000 $ 150,000 $ 300,000 $ 53,529 $ 0 $ 53,529 $ 54,779 $ 0 $ 54,779 $ 45,660 $ 150,000 $ 195,660 $ 153,750 $ 150,000 $ 5,000 $ 308,750 $ 187,749 $ 150,000 $ 337,749 $ 178,332 $ 150,000 $ 328,332 $ 211,987 $ 150,000 $ 361,987

| | ||||||

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND | | | 35 | |

Discussion and Analysis

| | ||||||||||||||||||||

| | ||||||||||||||||||||

| | For the purposes of this CD&A, the Summary Compensation Table, and other tables set forth in this Proxy Statement, our NEOs for the | | ||||||||||||||||||

| | ||||||||||||||||||||